Successfully navigating the complexities of Shopify shipping and tax can make or break your ecommerce journey. A streamlined system ensures timely deliveries, happy customers, and maximized profits. Comprehending these crucial aspects is essential for sustainable growth in the competitive online marketplace. This comprehensive guide will equip you with the knowledge and tools to optimize your Shopify shipping and tax strategies.

- Optimize your shipping process by integrating reputable carriers, calculating accurate rates, and offering various shipping options.

- Adhere to regulations with tax automation tools and stay updated on ever-changing tax laws.

Leverage the power of Shopify's built-in features and explore third-party apps to automate your shipping and tax management. By implementing these best practices, you can ensure a seamless shopping experience for your customers while maximizing your ecommerce success.

Simplify Shipping & Taxes on Shopify: Boost Your Operations

Running a successful Shopify store requires meticulous attention to detail, especially when it comes to shipping and taxes. These factors can quickly become complex and time-consuming if not managed effectively. Fortunately, Shopify offers a range of powerful tools and integrations to help you automate these processes, freeing up your valuable time to focus on growing your business.

- Utilize Shopify's built-in shipping calculator to provide accurate shipping estimates to customers at checkout.

- Investigate third-party shipping apps to access discounted rates, manage multiple carriers, and offer more shipping options.

- Integrate your Shopify store with a reputable tax app to ensure accurate tax determinations based on customer location and product type.

By adopting these strategies, you can enhance the shipping and tax experience for your customers while simultaneously improving operational efficiency.

Enhance Your Shopify Store: Shipping Rates and Tax Compliance Made Easy

Shipping costs and taxes can be a major headache for Shopify store owners. But, there's no need to stress. With the right tools and strategies, you can easily manage these essential aspects of your business and maintain a smooth checkout experience for your customers.

Let's start by|Begin with|To kick things off, let's explore some effective strategies for optimizing your shipping rates to increase profitability while keeping customer satisfaction.

Think about implementing multiple shipping options, including economy, expedited, and overnight delivery. This gives customers control over their shipping preferences and allows you to appeal a wider range of buyers.

Then, let's delve into the essential aspect of tax compliance. Shopify offers built-in tools to help you determine and collect sales tax accurately, ensuring that you stay compliant with all applicable regulations.

Leveraging these strategies, you can streamline the shipping and tax processes for your Shopify store, enabling website you to concentrate on other aspects of your business growth.

Shopify Shipping Calculator

Say goodbye to shipping headaches with the Shopify Shipping Calculator. This powerful tool provides precise shipping costs directly on your product pages, ensuring your customers know exactly how much they'll spend before checkout. Seamless integration means you can effortlessly calculate rates for various carriers and locations, simplifying the entire shipping process. With clear pricing, your customers will have a smooth and transparent checkout experience, building trust and driving sales.

Understanding Shopify's Automated Tax Calculation

Shopify simplifies the process of calculating taxes for your online store with its native tax calculator. This feature automatically determines the correct amount of tax based on the customer's location and the items being purchased.

To guarantee accurate tax calculations, Shopify deploys a comprehensive database of tax rules. This system is regularly updated to reflect any changes in tax codes.

Moreover, Shopify allows you to customize your tax settings to match with your business's specific needs. You can define different tax rates for various locations, omit certain products from taxation, and apply taxes on shipping costs.

By leveraging Shopify's automated tax calculation tool, you can ease the process of tax compliance and focus your time to expanding your business.

Setting Up Shipping Zones and Tax Rules in Shopify

One of the essential aspects of setting up your online store on Shopify is defining how you'll ship products to customers and handle tax calculations. This involves creating shipping zones that group customers based on their location, and then establishing specific shipping rates for each zone. You can also set tax rules for different locations, ensuring compliance with local regulations.

- To begin this process, navigate to the "Settings" section of your Shopify admin and then select "Shipping" from the sidebar menu.

- From there, you can create new shipping zones by defining their boundaries based on countries, states, or even postal codes.

- For each zone, you can specify delivery options and set corresponding rates.

- Under the "Taxes" section, you can configure tax rates for different locations, implementing standard or custom tax rules.

Remember to inspect your shipping and tax settings carefully to ensure they accurately reflect your business operations and comply with all applicable laws.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Robert Downey Jr. Then & Now!

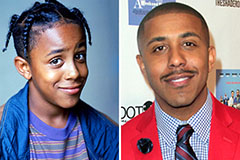

Robert Downey Jr. Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!